Tips to Avoid Overdrafts

There are many ways to prevent overdrafts from occurring. The best method is to keep track of your account.

-

Enroll in Online Banking and Mobile Banking. Frequently view your account balances with Online Banking and receive your account balances anytime, anywhere with Bank of Advance Mobile and Text Banking. If your account is getting low, instantly transfer funds between accounts from any computer or mobile device.

-

Create alerts. Set up an alert to let you know when your balance is getting low, an overdraft has occurred, a deposit or withdrawal is posted and much more.

-

Link with your savings account. With a “sweep” arrangement, you can have funds automatically pulled from your savings account when your checking account falls below a preset amount.

-

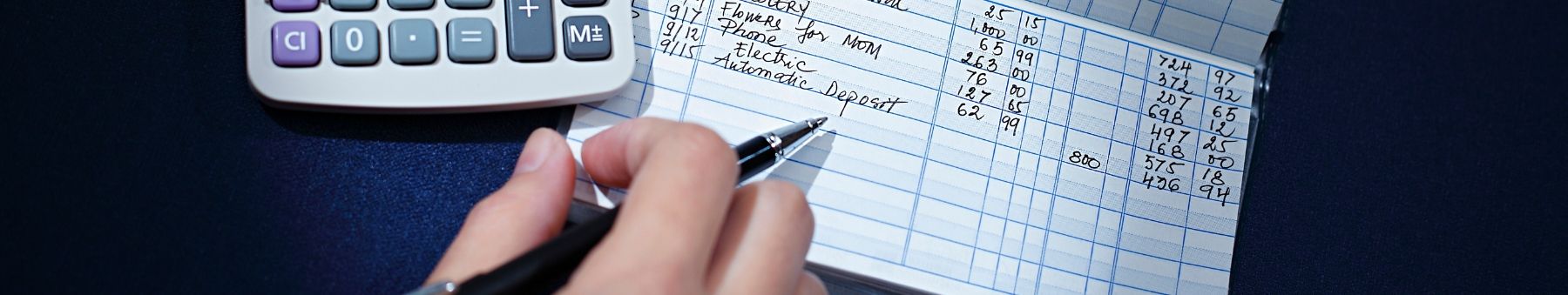

Keep your register updated. If you do not know how much money is in your checking account right now, then you are at risk of overdrawing your account. Make it a habit to enter each check or debit card purchase as it is made. Don’t forget to record ATM withdrawals and automatic payments and deposits. Set aside time when you get home to balance the register.

-

Review your statement. Compare your monthly statement to your check register and take care of any discrepancies immediately.